Introduction

Investing is one of the most effective ways to build wealth over time. Whether you’re saving for retirement, a major purchase, or financial independence, having a solid investment strategy is crucial. However, for beginners, the investment world can be overwhelming. Understanding the basics and implementing a structured approach can set you on the right path to financial success.

In this guide, we explore essential investment strategies for beginners, covering key principles, asset types, risk management, and long-term planning.

Why Should You Invest?

Investing allows your money to work for you and grow over time through the power of compounding. Key benefits include:

- Wealth Growth: Investments typically provide better returns than savings accounts.

- Beating Inflation: Investing helps preserve the purchasing power of your money.

- Financial Security: Long-term investments can support retirement and financial goals.

- Passive Income: Some investments generate regular income without active effort.

- Diversification: Investing in different assets reduces overall risk.

Understanding Investment Types

1. Stocks (Equities)

- Best For: Long-term capital appreciation.

- Risk Level: High, but offers high potential returns.

- How to Invest:

- Buy individual stocks.

- Invest in index funds or ETFs.

- Use Cases: Retirement savings, long-term wealth building.

2. Bonds

- Best For: Stability and regular income.

- Risk Level: Low to moderate.

- How to Invest:

- Government and corporate bonds.

- Bond mutual funds or ETFs.

- Use Cases: Fixed income, diversifying risk.

3. Mutual Funds and ETFs

- Best For: Passive investing with diversification.

- Risk Level: Varies based on fund type.

- How to Invest:

- Buy through brokerage accounts.

- Choose actively or passively managed funds.

- Use Cases: Low-maintenance investment portfolios.

4. Real Estate

- Best For: Passive income and asset appreciation.

- Risk Level: Moderate to high.

- How to Invest:

- Buy rental properties.

- Invest in Real Estate Investment Trusts (REITs).

- Use Cases: Income generation and long-term wealth.

5. Cryptocurrency

- Best For: High-risk, high-reward investment opportunities.

- Risk Level: Extremely high due to volatility.

- How to Invest:

- Buy Bitcoin, Ethereum, or altcoins.

- Invest in crypto ETFs or blockchain projects.

- Use Cases: Speculative trading and long-term blockchain adoption.

6. Index Funds

- Best For: Beginners looking for market-wide exposure.

- Risk Level: Moderate, depending on index composition.

- How to Invest:

- Choose S&P 500 or total market index funds.

- Invest regularly through automated contributions.

- Use Cases: Low-cost, long-term investing.

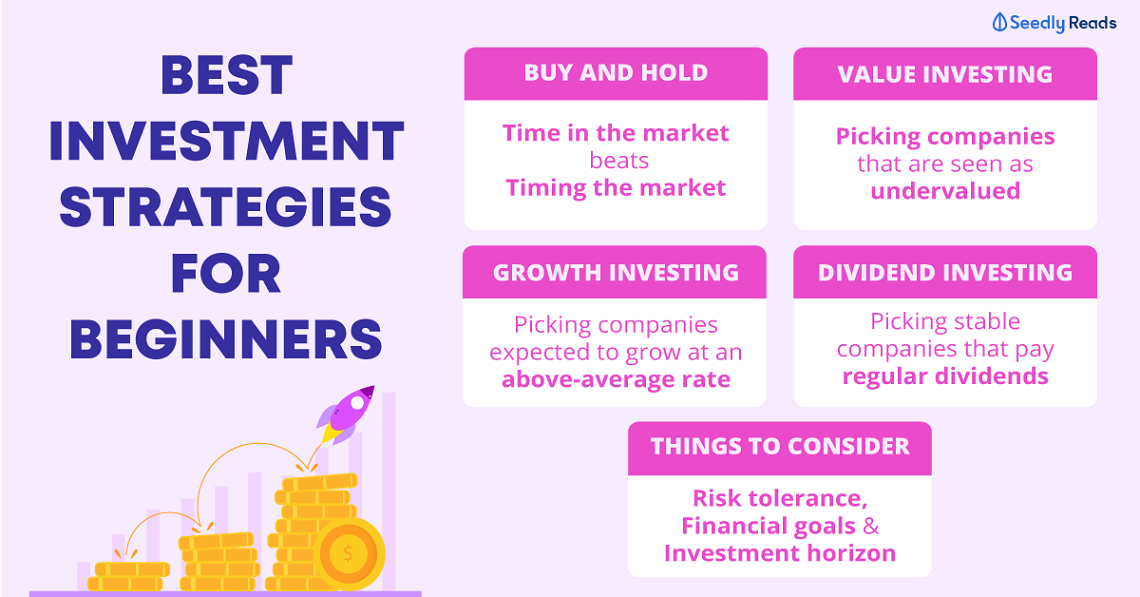

Key Investment Strategies for Beginners

1. Start with a Clear Goal

- Determine what you’re investing for (retirement, education, financial freedom).

- Set a timeline and expected return targets.

2. Diversify Your Portfolio

- Spread investments across different asset classes.

- Avoid putting all your money in one stock or sector.

3. Invest Consistently

- Use dollar-cost averaging (DCA) to invest regularly, regardless of market conditions.

- Automate investments to maintain consistency.

4. Understand Risk and Reward

- Higher returns often come with higher risks.

- Assess your risk tolerance and adjust investments accordingly.

5. Avoid Emotional Investing

- Stay disciplined and avoid panic-selling during market downturns.

- Stick to your investment plan and avoid impulsive decisions.

6. Reinvest Dividends

- Compounding interest accelerates growth over time.

- Choose dividend reinvestment plans (DRIPs) where available.

7. Keep Fees Low

- Choose low-cost index funds or ETFs to maximize returns.

- Avoid high-fee actively managed funds unless necessary.

8. Educate Yourself Continuously

- Stay updated on financial news and market trends.

- Read books, take courses, or consult a financial advisor.

Common Mistakes to Avoid

- Investing Without a Plan: Lack of strategy leads to poor decision-making.

- Chasing Market Trends: Avoid investing based on hype.

- Ignoring Fees and Taxes: High fees and capital gains taxes eat into returns.

- Not Rebalancing Portfolio: Periodically adjust asset allocation.

- Investing Money You Can’t Afford to Lose: Avoid using emergency funds for risky investments.

Recommended Investment Platforms

| Platform | Best For | Fees | Minimum Investment |

|---|---|---|---|

| Vanguard | Index funds, ETFs | Low | $0 |

| Fidelity | Stocks, mutual funds | Low | $0 |

| Robinhood | Commission-free stock trading | None | $0 |

| Coinbase | Cryptocurrency trading | Moderate | Varies |

| Fundrise | Real estate investments | Low | $10 |

Future Outlook: Where Should Beginners Invest?

- Index Funds and ETFs: Safe and diversified options for long-term growth.

- Technology Stocks: AI, cloud computing, and fintech offer high growth potential.

- Sustainable Investments: ESG (Environmental, Social, Governance) funds gaining popularity.

- Alternative Investments: Gold, crypto, and REITs for portfolio diversification.

Conclusion

Investing doesn’t have to be complicated. By understanding different asset classes, setting clear financial goals, and sticking to disciplined investment strategies, beginners can build wealth over time. Whether you choose stocks, bonds, real estate, or cryptocurrency, a well-diversified approach ensures stability and growth.

With the right mindset and ongoing learning, anyone can become a successful investor and achieve financial independence.